What if Pennsylvania Had the Same Severance Tax as Texas?

The prolific oil and gas producing state of Texas imposes a 7.5 percent severance tax on natural gas produced within the state, and 4.6 percent levies on both oil and condensate. In a recent post, I mentioned that if Pennsylvania had the same severance tax as Texas, the Commonwealth would have raised about $72.5 million last year–just from non Marcellus Shale oil and gas wells.

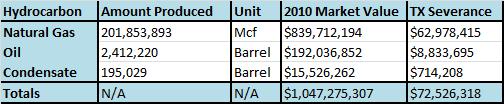

Estimated market value and hypothetical severance tax of non Marcellus Shale well production in 2010.

In the table above, the market values were determined by multiplying the total production with the average price for the wellhead price of gas and petroleum and other liquids, respectively.

That may not be enough to plug the gaping hole in Pennsylvania’s budget, but it would at least be enough to fill a few potholes. But what if we took Marcellus Shale production into consideration as well?

Unlike wells from other formations where the production report coincides with the calendar year, Marcellus Shale production is available for the period from July 2009 through June 2010, and from July to December 2010. While there were certainly more Marcellus wells toward the end of the year than the beginning, this is more than made up for by the likelihood that the self-reported Marcellus production data is dramatically understated. I say this because there are only 1,255 wells reporting any production in the last half of the year, and yet there were 2,498 Marcellus wells by year’s end. So while I will multiply the six month totals by two to represent the whole year, multiplying by four might be more accurate still.

Estimated market value and hypothetical severance tax of Marcellus Shale well production in 2010.

Taking the self reported data at face value, we are now looking at a hypothetical severance tax of $246 million for all formations. While that won’t solve the budget problems either, it would be enough to preserve the jobs of thousands of teachers throughout the Commonwealth.

Former Governor Rendell did little to promote a severance tax in his tenure until the very end, and Governor Corbett has stated his opposition repeatedly. However, in the interest of paying our bills without jeopardizing our fragile economic recovery, the idea of the severance tax is clearly worth another look.

It can’t be that bad for the industry. After all, they’re still drilling wells in Texas.

>Yes, all production data is self reported by the industry to the DEP. It is available here: https://www.paoilandgasreporting.state.pa.us/publicreports/Modules/DataExports/DataExports.aspx

>This is a great example! Just wondering what source you used for the Marcellus 6 month production and the non-Marcellus 2010 amount produced? Is it all industry reported to the DEP?