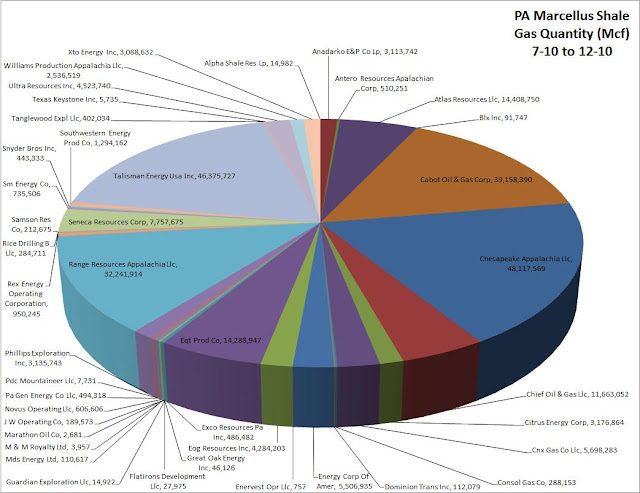

PA Marcellus Shale Production by Municipality

Marcellus Shale production by municipality. The darker red municipalities have higher production, illustrating that gas production in these gas wells comes in “hot spots”, particularly in the northeast and in the southwest.

It is no secret that there is money to be made in the natural gas industry, not only for the industry, but for those leasing their mineral rights as well. Pennsylvania law requires that a royalty of at least one eighth of the wellhead price of gas be paid to the owner of the land’s mineral rights.

And yet, we continue to hear stories, such as the one about Ron Gulla, who leased his land, which was subsequently damaged by drilling operations, all for apparently no money. How can this be? According to Mr. Gulla, it was because his gas was “wet gas” which needs to be processed. The DEP website makes no such distinction. Just to be sure, I called the Harrisburg office of the Bureau of Oil and Gas Management. Their response was that wet or dry, the drilling operators are required to pay at least one eighth of the wellhead price of gas as a royalty fee.

Is it possible that after all the drilling and hydraulic fracturing and dead fish and ruined farm that there was just no gas produced from that well?

First of all, let’s find Mr. Gulla’s former community. We know from the story referenced above that he was from Hickory in Washington County. In terms of this map, that places him in the middle of Mount Pleasant Township, so let’s take a closer look at what’s going on in that area.

Average six month gas production for Mount Pleasant Township in Washington County, PA, by municipality. Production values are from 7-1-10 to 12-31-10. Click the gray compass rose and double carat(^) to hide those menus.

If you click on the “i” button in the blue circle, then the red shape in the middle of the screen, we can learn quite a bit about gas production in Mount Pleasant Township. For example, we know that there were 94 wells in the township, each producing an average of 57.8 million cubic feet of gas in the six month period of July to December 2010, for an estimated minimum royalty check of just over $30,000. That’s a lot of gas and a lot of money. So where was Mr. Gulla’s?

Average six month gas production for Mount Pleasant Township in Washington County, PA, by municipality and by well. Production values are from 7-1-10 to 12-31-10. Click the gray compass rose and double carat(^) to hide those menus.

If the statewide trend is one of hotspots, at the township level, we are now looking at hotspots within hotspots. While many wells in Mount Pleasant Township produced over 300 million cubic feet of gas in the six month period, many others produced very little. And if Mount Pleasant is a moderately high producer of Marcellus Shale gas, and Chartiers Township to the southeast is a heavyweight, it makes it all the more curious that Cecil Township to the northeast and Smith Township to the northwest have no Marcellus Shale activity at all.

So maybe you have a neighbor who hit the jackpot with the Marcellus Shale gas boom, but does that mean that you will?

Average six month minimum royalty fees by township. Note the large number of municipalities with low or no royalty averages, and the very high dollar amounts in some other communities. Click on the gray compass rose and double carat (^) to hide those menus.

From this map, you can get an idea of what the average six month well royalty check might be for a well in your community. The figures for this map are based on the production values, above, times 0.125 times the average wellhead price of gas in 2010. But as we’ve seen in Mount Pleasant, there are some holes where the gas just doesn’t flow.

After taking this to another level of complexity, the lesson is pretty much the same as before: There is money to be made in the Marcellus Shale gas extraction industry–sometimes. As Mr. Gulla’s story reminds us, there are hardships as well. The DEP issued 9,370 oil and gas violations in a period of less than four years. Things can and sometimes do go wrong, and even when they don’t, around the clock industrial action for months on end in your backyard may be at odds with your bucolic lifestyle, or that of your neighbors.

So if you leased your land, would you cash in? At best, you can look at the numbers and play the odds, but there’s only one way to find out for sure.