Comparing & Contrasting Extractive Industry Sectors in Ghana & the US

By Deanna Bitetti (Common Cause) and Samantha Malone, MPH, CPH (CHEC)

In the quiet of the morning the group we have travelled to Ghana with using a grant from the US Department of State to study extractive industries find ourselves swapping stories – wistfully thinking of American life back home. We find ourselves constantly comparing and contrasting the political environment in which public policy around extractive industries are crafted in both nations. Scratch beneath the surface and you will find that Ghana and the US are not that different after all.

The pernicious influence of special interest money permeates throughout American political culture just as it does in Ghana; compulsory Integration models in the states have allowed for mineral rights to be taken from American citizens, and confusion over the leasing of mineral rights for natural gas extraction has led to uprooted communities. Environmental degradation and costs to local communities have been paramount in both the US and Ghana. These two nations separated by the Atlantic are struggling to balance new extractive industries as an engine for economic growth and protecting communities from the pitfalls associated with the “resource curse.” As both nations forge ahead in developing their oil and gas sectors, how they manage the risk associated with natural gas development will ultimately define how the citizenry thinks about the role of government and government institutions.

Below is a short comparison of some key aspects affecting constituencies in the US and Ghana.

Special Interest Influence

During a recent discussion with a local royal chief in a small village I am reminded that corporate influence is not localized to any specific nation. Here, a gold mining company publicly presents the tribal leaders of a village with keys to two Land Rovers. In America, special interest money floods campaign coffers, exceedingly so in the wake of Citizen United. According to Open Secrets individuals and political action committees affiliated with oil and gas companies have donated $238.7 million to candidates since 1990. From 2010-2011 Exxon Mobil and The Koch Brothers, one of the largest oil and gas conglomerates in the US, spent $384,030 and $318,800 respectively on campaign donations on both sides of the partisan divide to influence environmental legislation aimed at regulating the oil and gas sector. In Pennsylvania, Common Cause’s www.marcellusmoney.org has tracked the significant campaign cash contributions that have flooded campaign coffers, and in New York our recent report “Deep Drilling, Deep Pockets,” highlighted the large amounts industry has spent to lobby our elected officials.

Public Benefits for Public Good

In Ghana only 5% of royalties paid by the extractive industry sector is paid to the State. Out of that 80% of the money goes into the government’s general fund, with only 9% trickling down to effected communities. In the US, Congress has historically rewarded energy companies and those involved in the extractive industry sector with tax breaks, without tangible realization of positive benefits to communities. Nearly two-thirds of US corporations don’t pay any income taxes. According to a study from the non-partisan Government Accountability Office, 83 of the top 100 publicly traded corporations that operate in the US exploit corporate tax havens. Since 2009, America’s most profitable companies, such as ExxonMobil, General Electric, Bank of America and Citigroup, all paid a grand total of $0 in federal income taxes. Even as we write this, Congress is considering offering major subsidies to promote natural gas extraction methods and providing major tax incentives to the industry, speeding up the timeline for extraction and feeding the natural gas boom (and possibly bust) cycle.

Mineral Rights and Extraction

At the heart of the debate over natural gas extraction in the US is the right of landowners to either retain their land or sign leases with companies with the hope of negotiating lucrative contracts for their mineral rights. In Ghana, Article 257 of the Constitution states that public lands and public property are “vested in the President on the behalf of, and in trust for, the people of Ghana.” In essence, the state has claims to mineral rights, not the individual. On the surface the situation in Ghana appears anathema to American values. Forced resettlement programs of thousands of fisherman, farmers and landowners offends our notion of private property and ownership as inviolate. Yet areas in New York and Pennsylvania have allowed for Compulsory Integration where companies were granted the right to drill on lands for which they did not hold leases. Some residents that may own the surface rights but not the mineral rights experience the effects of a “split estate.” Additionally, population displacement often occurs near areas of heavy drilling either because of fear of health effects, noise or pollution, or due to harassment by companies. The important benefits and drawbacks that result from personal ownership of mineral rights must be considered seriously. Further, neither the United States or Ghana require companies to disclose the exact composition of the chemical mixtures used in the process, shrouding it in a cloud of secrecy from the public.

Externalities of Natural Gas Development

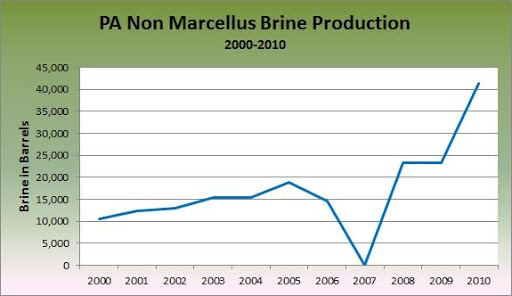

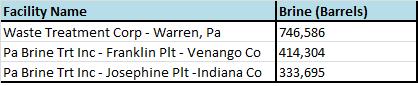

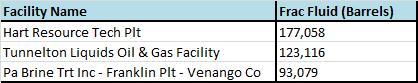

In Ghana, as farmland is turned over to industry to pave the way for rapid development, food productivity has begun decreasing – causing food and commodity prices to rise. Housing prices have been steadily increasing as foreigners flock to the areas surrounding the Jubilee oil field, causing a surge in demand for those residences. Prostitution and crime has been on the rise, as well. Even smoking has increased as foreigners bring with them new social norms. In the US we have seen similar externalities imposed on host communities by the extractive industry sector. In Pennsylvania we have already seen the rise in housing shortages due to workers being brought in from out of state, traffic incidences, and roadway degradation. Air quality concerns, drinking water contamination, and stress-related health effects are being documented. Both nations lack clear and updated standards for hazardous waste removal of drilling fluid or drill cuttings. Each country will have to address new pressures placed on transportation infrastructure, including increasing maintenance costs as new roads are created and old roads need constant repair to handle the increase in heavy truck traffic.

Public Health Issues

Residential and operational waste – regardless of its country of origin – is a common postcard to receive from the presence of extractive industries. Improperly handled waste contributes to a multitude of public health issues, such as tainted drinking water, disease transmission, air pollution, and threats to the food supply. One of the differences between Ghana and the U.S. lies in the awareness of where our waste goes. Americans are physically separated from the sources and end products of our distracted commercial lives. Trash is collected by a contractor and taken to dump sites, incinerators, or overseas. Ghanaians face their (and others’) waste on the country’s busy sidewalks, in open sewers, and floating in their magnificent waterways. They witness the neocolonial exploitation of their local resources for the imbalanced consumption and financial gain of other countries. While our processes for extraction and waste disposal differ somewhat, we share a common problem – how to reduce our demand on the entire cycle. Many of the earth’s resources are finite and severely threatened, and so sustainability must be the prescription for healthy development.

Conclusion

This list is not exhaustive, nor it is it meant to be. To move toward a best-practices model for developing extractive industry sectors and managing the high risks associated with doing so means paying close attention to the pace and scope of development, as well as attempting to ameliorate negative externalities imposed on communities. This must include mechanisms for proper oversight and regulation, sustainable planning and development, enhanced civic societal input at the decision- making table, and realistic expectations about the financial promises of oil and gas. In nations such as Ghana, managing these revenues will require more transparency and better management to ensure that revenues do not create large wealth distribution imbalances. In the US, ensuring that industry and government do not form cozy relationships that undermine independent oversight regimes is a major concern.

Deanna Bitetti is the Associate Director of Common Cause/NY. Samantha Malone is the Communications Specialist at the Center for Environmental Healthy Environments and Communities and a doctorate student in the University of Pittsburgh Graduate School of Public Health. They are currently in Ghana as part of a State Department funded research trip on resource extraction hosted by Duquesne University (Pittsburgh, Pennsylvania) and the University of Ghana (Legon, Ghana).